The surge in popularity of digital currencies continues to attract new potential investors, leaving many wondering about the safest ways to buy cryptocurrency.

In recent years, cryptocurrencies have dominated financial discussions, lacking the security measures of traditional finance. Therefore, it is crucial for investors to navigate the crypto market securely to protect their assets and personal information.

Various options are available for purchasing digital currencies, ranging from exchanges to peer-to-peer (P2P) platforms, each offering a way to buy cryptocurrency while minimizing risks.

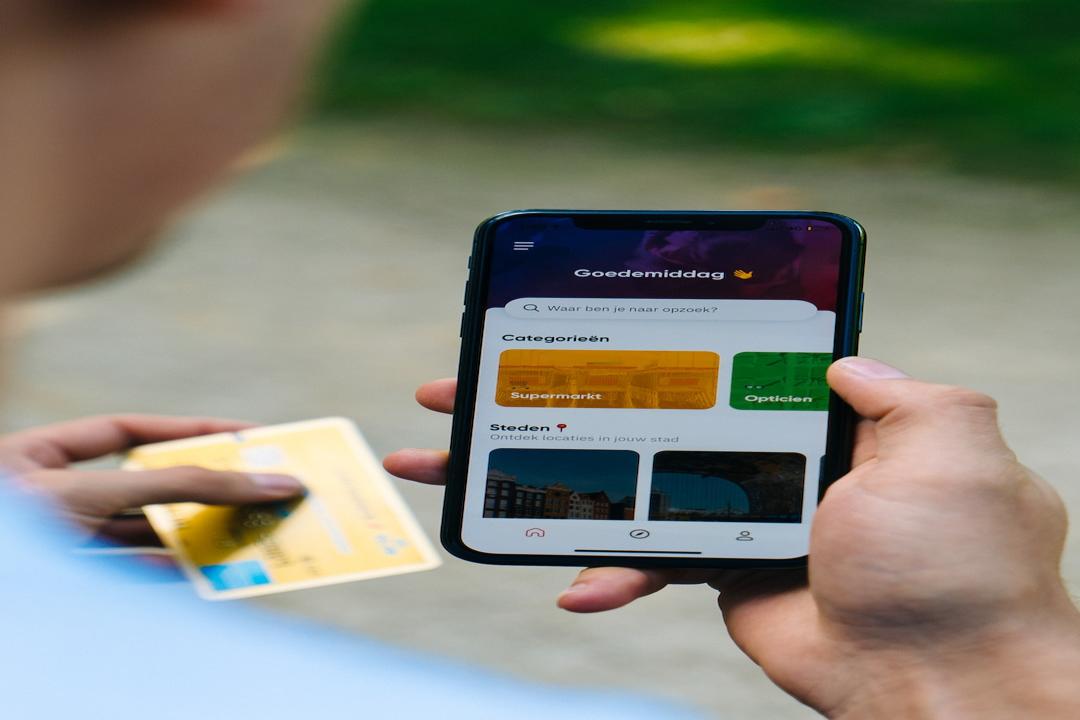

Cryptocurrency exchanges are a popular choice among enthusiasts, considered one of the safest methods to purchase digital assets. Researching reputable exchanges with strong security measures, positive user reviews, and compliance with local laws is essential. Creating an account, enabling two-factor authentication, and using secure payment methods are key steps for a safe transaction.

Peer-to-peer (P2P) platforms offer a decentralized marketplace for direct crypto transactions, without intermediaries. Choosing a platform with escrow services, dispute resolution mechanisms, and positive user reviews is crucial for safe transactions. Users should vet their trading partners, avoid sharing personal information, and double-check wallet addresses to prevent scams.

Cryptocurrency ATMs provide a convenient way to buy or sell crypto using cash or debit/credit cards. Verifying the operator’s credentials, understanding fees, and avoiding ATMs with excessive KYC procedures are recommended for a safe transaction. Users should be cautious of suspicious behavior and tampered ATMs to prevent scams.

Over-the-counter (OTC) desks facilitate large-volume crypto trades directly between buyers and sellers. Conducting thorough research, assessing security measures, and reviewing terms and conditions are essential for a safe transaction. Clear communication with the OTC desk representatives can help negotiate terms and address concerns.

Cryptocurrency mining involves adding transactions to a blockchain and minting new coins. Educating oneself about the process, hardware requirements, costs, and potential risks is crucial before diving into mining. Implementing security practices and staying updated with reputable mining software can prevent theft and cyberattacks.

In conclusion, whether new to cryptocurrencies or a seasoned investor, evaluating risks and understanding legal implications is vital when buying cryptocurrency safely. Diversifying purchases across multiple platforms and using different trading strategies can help mitigate risks. Consulting legal and tax professionals for compliance with regulations is recommended.

FAQs

– What are the safest apps to buy crypto?

Popular apps like Coinbase, Kraken, and Binance are known for their reliability, security features, and regulatory compliance. However, users should do their own research to ensure the app meets their needs.

– How can I buy and store cryptocurrency safely?

Researching security features and reviews of platforms, using hardware or software wallets, and implementing security measures like two-factor authentication and strong passwords are ways to safely acquire and store cryptocurrency.

– Is it safe to buy crypto with a credit card?

Buying crypto with a credit card is safe, but users should be vigilant against fraud, chargebacks, and high fees compared to other payment methods like bank transfers.