In the previous month, the impact of U.S. macroeconomic factors and geopolitical unrest infiltrated the crypto market sentiment, resulting in a significant decrease in trading volume not witnessed in over 30 weeks.

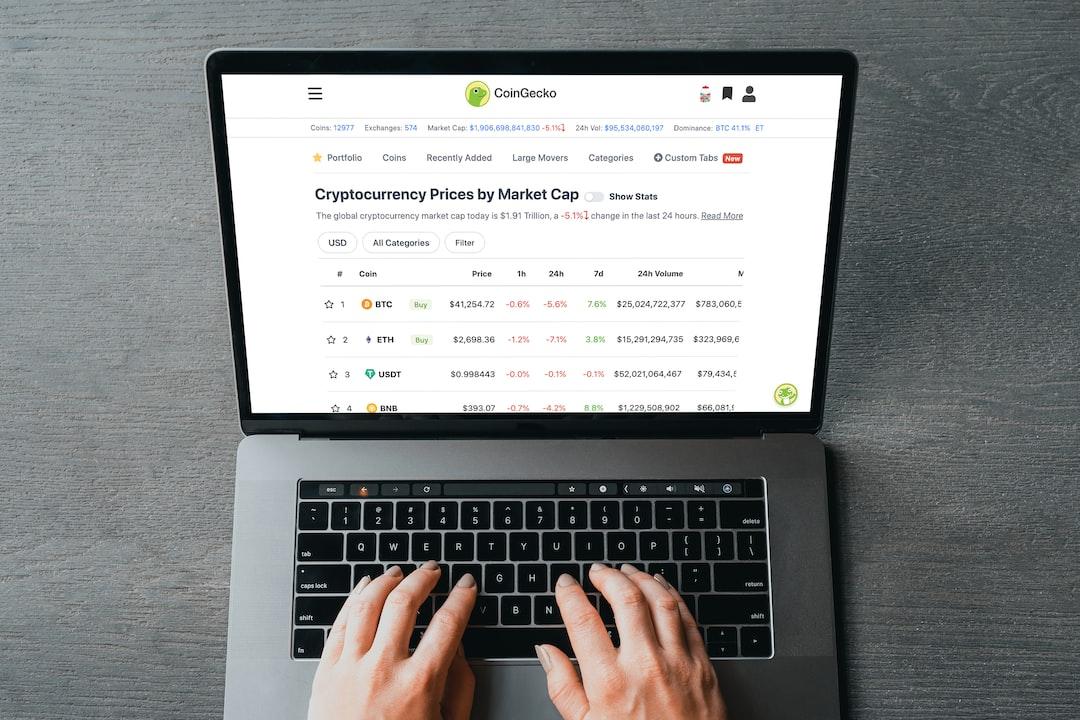

Data analytics from CCData revealed that spot trading volumes on major cryptocurrency exchanges such as Binance and Coinbase experienced a sharp decline of 32.6% as a widespread market correction unfolded. The spot trading volume dipped to $2 trillion for the first time since September of the previous year. Additionally, trading volumes for derivative tokens also hit a seven-month low of $4.5 trillion, marking a 26.1% decrease. Binance, the largest centralized exchange, saw a decrease in market share as trading activity retreated from earlier highs this year, dropping by 4% to 33.8%.

The data provider suggested that this trend reversal may be linked to a historical pattern following Bitcoin halvings. A recent halving event reduced the number of newly mined tokens by 50%, leading to a decrease in revenue for Bitcoin miners and an increase in scarcity of BTC. CCData researcher Jacob Joseph noted that CEX trading had cooled off following previous halvings, attributing the decline to ongoing inflation concerns in the U.S. that have shaken investor confidence in potential rate hikes.

Earlier this year, the approval of spot Bitcoin ETFs by the U.S. SEC boosted bullish sentiment and propelled crypto prices to new all-time highs. Bitcoin surpassed its previous ATH of $69,000 from 2021, reaching over $73,000 in March. Despite Wall Street giants like BlackRock and Fidelity amassing over $10 billion in assets under management shortly after launching, recent outflows have been observed.

While the market appears to have entered a post-halving period of calm and spot BTC ETFs have struggled to attract new liquidity, Manthan Dave, co-founder of Palisade, expressed confidence in the potential for higher prices by the end of the year. Dave also suggested that the approval of spot Ethereum ETFs could bring more capital into the crypto markets and provide an alternative to Bitcoin-focused investment vehicles.