Disclaimer: The opinions expressed in this article are solely those of the author and do not necessarily reflect the views and opinions of the editorial team at crypto.news.

Over the past two decades, the banking sector has witnessed a significant transformation in the realm of fraud detection and prevention. Initially, fraud analysts operated as traditional investigators, relying on intuition and direct communication, often collaborating with law enforcement to combat fraud. With limited payment options like bank transfers, credit cards, and checks, fraud detection was relatively straightforward. Merchants utilized secure transaction services to verify cardholder identities, while banks relied on rigid, rules-based mechanisms to address fraud, overlooking the nuances of cardholder behaviors and profiles.

In the current landscape, the dynamics have shifted dramatically. The adoption of EMV chip cards for Card Present transactions has redirected the focus towards online and mobile channels. As payment methods have diversified, fraud has evolved to adapt to the digital space and our hybrid lifestyles. This evolution has necessitated a strategic shift in fraud prevention departments, leading to the integration of new technologies to detect and prevent emerging threats.

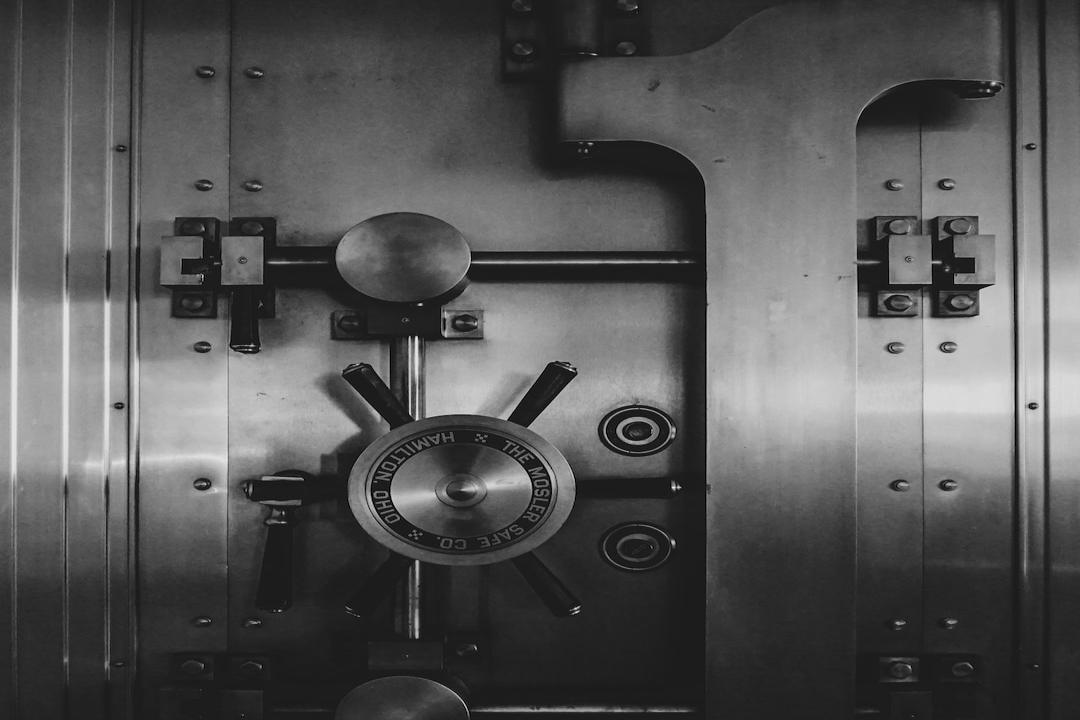

Addressing these challenges in the centralized, monolithic banking system poses a formidable task. The existing bank infrastructures are accustomed to closed ecosystems where fraud detection is facilitated by the abundance of customer profiles and habits. The concept of malicious actors remains unfamiliar. In essence, banks detect unauthorized payments not based on identifying bad actors, but by recognizing discrepancies in customer behavior.

Similar processes are now unfolding in web3. The disruption introduced by web3 has exposed numerous vulnerabilities. Currently, efforts are focused on patching these vulnerabilities through smart contract audits and bug bounties. However, users often find themselves vulnerable to evolving scams and attacks. Much like in the banking sector, many security measures in web3 are reactive, focusing on investigating incidents rather than proactively preventing them. Furthermore, establishing standard user profiles is challenging in the fluid blockchain environment, where users can operate multiple addresses for various tasks.

The user experience in web3 security issues demands an integrated approach with core infrastructure, mirroring the evolution of security in the banking and cashless payment industries. Expecting every web3 user to navigate the complexities of security solutions is unrealistic. While some users resort to installing security extensions to safeguard their wallets, the fundamental issue remains: security is not the default state in web3.

Comparing the current state of web3 to a dangerous street teeming with criminals underscores the need to prioritize prevention over reaction. Rather than arming individual users with protective measures, the emphasis should be on creating a secure environment by default. This paradigm shift is imperative for sustainable growth and trust in web3 technologies.

Integrating security directly into the core infrastructure of web3 is crucial for achieving a genuinely secure environment. This requires a collaborative effort from all stakeholders, encompassing developers, platform providers, regulatory bodies, and end users. By shifting from reactive to proactive security measures, we can create a safe and secure web3 ecosystem that instills confidence and trust among users.

In conclusion, the evolution of web3 security must transition from reactive, isolated measures to proactive, integrated solutions. By embedding security at the core infrastructure level and engaging all stakeholders in this endeavor, we can foster an innovative, decentralized, and secure web3 environment that benefits all users. Embracing this path not only safeguards digital assets but also nurtures the trust and confidence essential for the growth and success of this transformative space.